Understanding Annuity Payment Structures

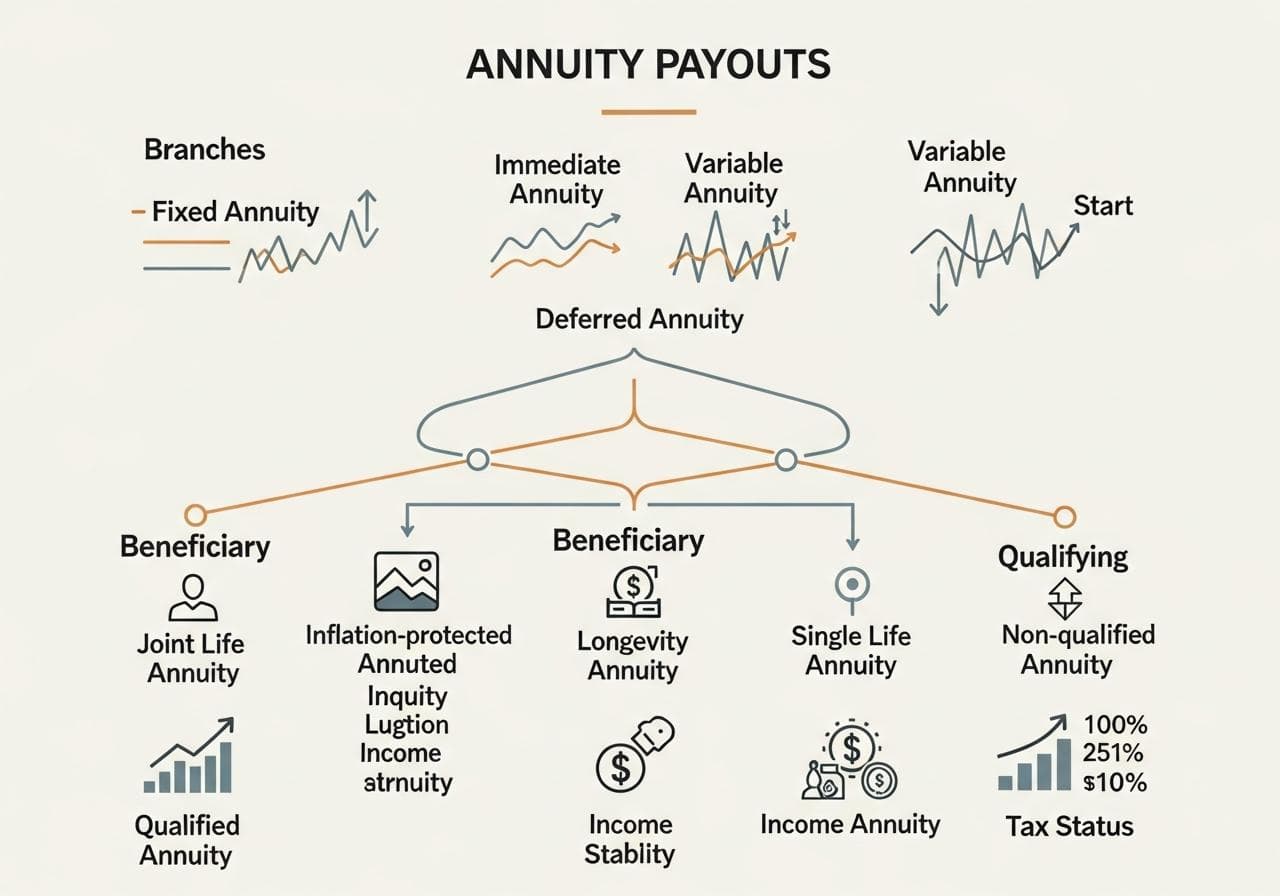

Annuity payouts involve diverse structures, impacting income streams. Choices affect payment frequency, amounts, and duration.

Research topics

What is an Income Annuity?

An Income Annuity is a financial product designed to provide you with a steady stream of income, typically during your retirement years. This kind of annuity is particularly beneficial because it helps ensure that you won’t outlive your savings. With an Income Annuity, you pay a lump sum either in a single payment or through installments, and in return, you receive regular payouts over a specified period or for the rest of your life.

Types of Annuity Payout Structures

There are several ways to structure your annuity payout, and understanding these differences can help you make the best choice for your financial future. The two main categories of annuities include Fixed Annuities and Variable Annuities. Fixed Annuities offer a guaranteed payout, which is perfect for those who want predictable income, while Variable Annuities allow you to adjust your payouts based on investment performance, bringing both opportunities and risks.

Immediate Annuities begin paying out right after you make your initial investment, whereas Deferred Annuities allow you to delay payouts for a specified period, allowing your investment to grow. For those looking to secure funds for the long haul, a Longevity Annuity can provide income that kicks in at an advanced age, ensuring that you have financial support in your later years.

Qualified vs Non-qualified Annuities

Understanding the difference between Qualified Annuities and Non-qualified Annuities is crucial in planning your retirement. Qualified Annuities are funded with pre-tax dollars, often stemming from retirement accounts such as 401(k)s or IRAs. This means your payouts are taxed as income when you withdraw them. In contrast, Non-qualified Annuities are funded with after-tax dollars; therefore, only the earnings portion is taxable upon withdrawal.

This distinction impacts how you'll plan for your financial future, as the tax implications can significantly influence your income stream. If you're considering entering the annuity space, using an annuity payout calculator can help you dissect the intricate details of potential payouts from both types of annuities.

Life Annuity Structures

Life annuities come in different forms, primarily focusing on who will receive the payments. A Single Life Annuity provides lifetime income to one individual, making it a good choice if you have no dependents or other financial considerations. On the other hand, a Joint Life Annuity ensures that both you and your spouse receive payouts until both individuals pass away, which can provide a sense of financial security.

Some annuities even offer inflation protection options, and an inflation-protected annuity can help your payouts maintain their purchasing power over time. These options could be particularly valuable as living costs continue to rise.

Making a Decision: Key Considerations

When choosing between different annuity payout options, it’s essential to evaluate your personal financial situation, spending habits, and future goals. One of the benefits of an Income Annuity is its simplicity and peace-of-mind factor. You receive consistent income, allowing you to plan your budget more effectively.

Consider factors such as your expected life span, other retirement income sources, and any outstanding debts you may have. If you're not sure which path to choose, consulting retirement advisors or using online resources may provide additional clarity and guidance.

The Bottom Line

An income annuity can be an invaluable tool in creating a reliable income stream for retirement. With various structures, including both fixed and variable payouts, and the option for immediate or deferred income, understanding your choices is critical. Be sure that you know the implications of qualified versus non-qualified annuities so that you can make informed decisions.

Whether it’s a Single Life Annuity or a Joint Life Annuity, each choice has its pros and cons. Tools, like the various annuity payout options, can help you visualize what income scenarios will work best for your situation. Retirement planning is all about finding what works for you, and understanding annuity payment structures is a step in the right direction.

Posts Relacionados

5 Tips For Sticking To A Budget

Simple money management includes planning, tracking expenses, cutting costs, saving, and reviewing your financial plan consistently.

5 Ways To Save Money On Business Insurance

Find affordable business insurance by comparing quotes, bundling policies, and assessing coverage needs efficiently.

5 Ways To Save Money On Groceries

Simple strategies include meal planning, using coupons, and buying in bulk to reduce grocery expenses effectively.